How To Fix Your Finances Part 1 — Where Does It All Go Now ?

This is a change of topic for me, but as job losses during coronavirus and the spiralling costs of living are having a huge impact on people’s lives and mental health (see, there’s the tie in to my blog!) I want to talk about how to fix your finances. As well as the horrific loss of life coronavirus and the war in Ukraine has badly impacted tens thousands of us. How? It shone a spotlight on that dark corner of our lives many of us try to avoid…how precarious our personal finances are. So, let’s take a look at how to fix your finances.

My Past

I’ve been in debt in the past. A lot of it. Not one of those poor souls on the edge of bankruptcy and using one card to pay another, thankfully. I had unsecured debt totalling around 75–80% of my annual income. Yikes!

I did realise how unsustainable this was and over the last few years, it’s reduced significantly. Or not depending on how you look at it. I have a mortgage! I don’t worry about my mortgage though. I see it as an investment and the interest rate is significantly lower than on unsecured debt.

Until last year, I thought my finances were fine. Everything was getting paid. Our only non-mortgage debt was one credit card for a few thousand. Thanks to a small windfall from the estate of my husband’s grandmother we even had a few thousand in savings. Sounds good, right? Wrong!

Enter Coronavirus

I started a new job in February last year. It paid a bit more than my current job and had more responsibility. I was enjoying it and all looked rosy. Then, 7 weeks in, coronavirus hit. The company wasn’t in great shape, to begin with, and I’d been hired by the company that bought it out. Within weeks this struggling company was flatlining and I received an email to my home address informing me I was being made redundant.

After I got over the shock and had a good long cry I gathered myself enough to re-read the email. It told me that as the UK government had introduced a scheme to pay up to 80% of a worker’s salary I would be furloughed for as long as the scheme was in operation.

I’m sure you can imagine how immense my relief was! I still had a salary coming in. Ok, it was only 80% of it but that was a lot better than living on government benefits. I could pay my bills. I had room to regroup. After 2 months of frantic searching, I found another job. It’s paid worse than the job I originally left but it’s a wage and I was lucky to have it. My story had a happy ending. So many others don’t.

Reality Check!

Finance experts say we should all have at least 6-months’ salary in the bank for emergencies. Ha! Most of us barely have 6-weeks’ salary if we’re lucky. Many have none at all. That’s why we all need to take a long, hard look at our finances now, before a catastrophe strikes. Let’s get started.

Step 1: Where Does Your Money Go?

It’s vital you don’t skip this step as uncomfortable as it might be for you. There’s no point springing into action to fix a problem that you don’t fully understand. You may end up rushing around putting out small fires while there’s a wildfire burning just out of your sight. The first step in learning how to fix your finances is to understand your current position. All of it. Down to the penny.

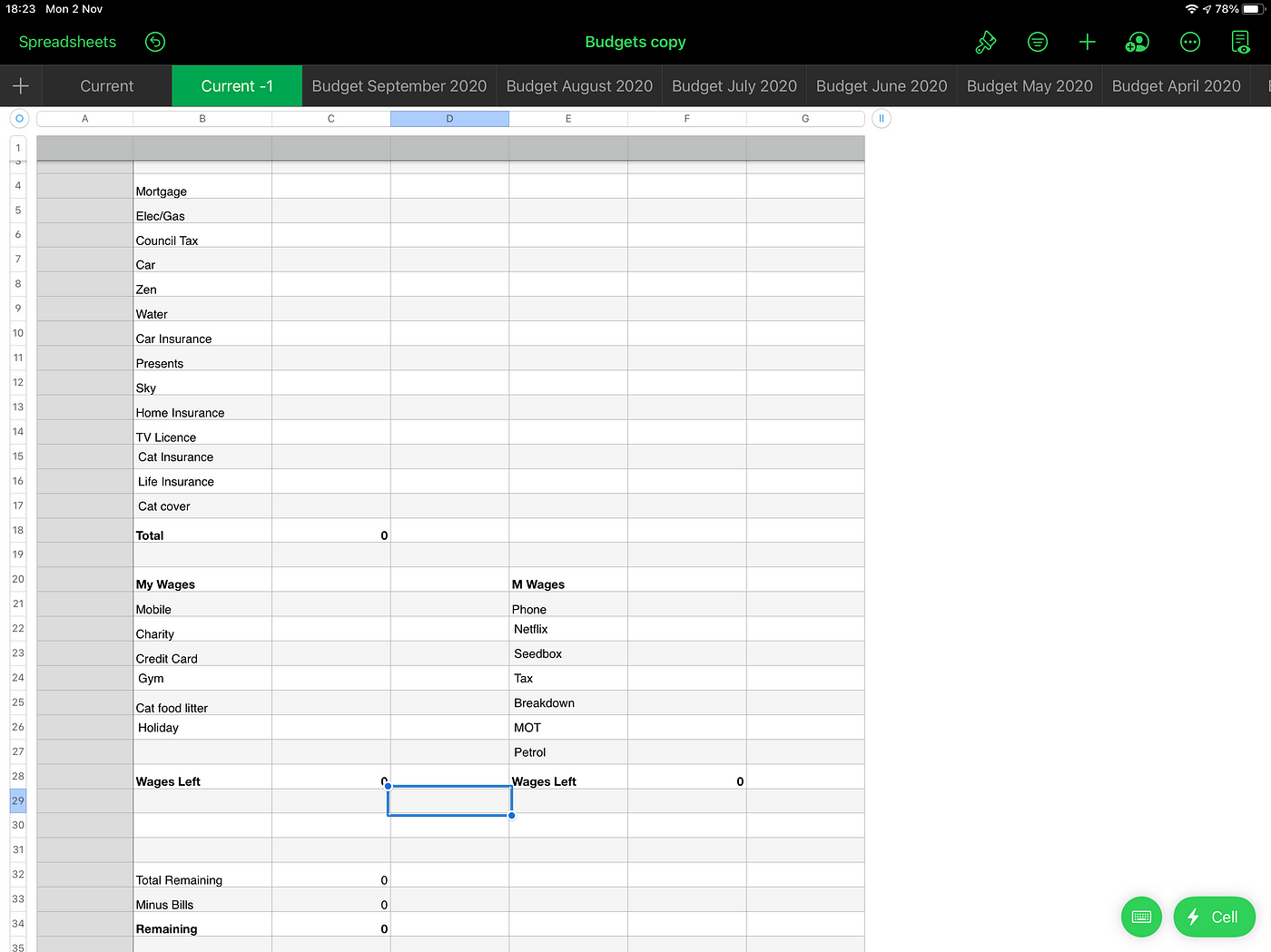

You should start by looking at your statements. First your bank statement and then any others for credit cards, store card and catalogues. You’re going to need to write down all your monthly payments. Every. Single. One. Even the £5 a month you donate to charity or £10 for the window cleaner. I think it’s best you do this in a spreadsheet program so you can easily adjust it and add it up but it’s up to you.

I have a spreadsheet that I started in 2007 when my husband and I moved in together. On it, I have household bills at the top then my husband’s and my individual outgoings at the bottom in 2 columns. I start a new sheet each month and have a record of every month for over 13 years. I cannot recommend this enough. When you have it all in black and white it is simple to see what your outgoings are. You can also spot if you’ve missed anything.

Step 2 — What Do You Spend The Rest On?

Having a list of your bills is great. It lets you calculate how much you need to bring in each month and how much disposable income you have left. It’s not the full story though. The next question is where does your disposable income go?

If you’re like me and do the majority of your spending using your cards this part shouldn’t be too tough. Go through your bank statement and your credit card statements if you buy things with them too. Categorise your spending. You can be as specific here as you like. Some people split it into broad categories like Food, Eating Out, Clothes etc. Others go in-depth and have lines for Costa, Subway, Tesco, H&M and so on.

If you mostly buy things with cash then this part will take a bit longer. You need to keep a spending diary for at least a month. In it, you need to write down every single thing you buy. Yes, even a bottle of water at the gym or a pack of chewing gum. Nothing is too small or insignificant.

Step 3 — Absorb the information

Don’t try to make any changes yet. You’ve done a great job taking stock of where you are right now. It might have been a big shock for you. If so, I know it’s hard but it’s better to know.

Burying your head in the sand just guarantees you’ll be in the same position or worse in 6 months.

Over the next few days just let the figures sink in. What bothers you the most? Is it that you spend £150 per month on buying lunch? Or maybe that you pay more than a third of your wages each month to pay your debts. What do you feel happy with? Is there anything you could easily live without?

Once you’re armed with the data from your monthly budget and you’ve processed how you feel about it you’ll be ready for part 2 in my how to fix your finances series. See you in a few days!